Gap close trading

is a popular strategy among day and swing traders. It is based on the principle that price gaps created by overnight or intraday market events often get “filled” as price retraces to the previous close level.

🔍 What Is a Price Gap?

A price gap occurs when a stock opens significantly higher or lower than its previous closing price, skipping over a range of prices.

Types of gaps:

Common Gaps: Small and frequent, usually in sideways markets.

Breakaway Gaps: Signal the beginning of a trend.

Exhaustion Gaps: Appear at the end of a trend.

Continuation Gaps: Appear during strong trends.

Gap close trading focuses on the idea that most gaps—especially common and exhaustion gaps—tend to be filled.

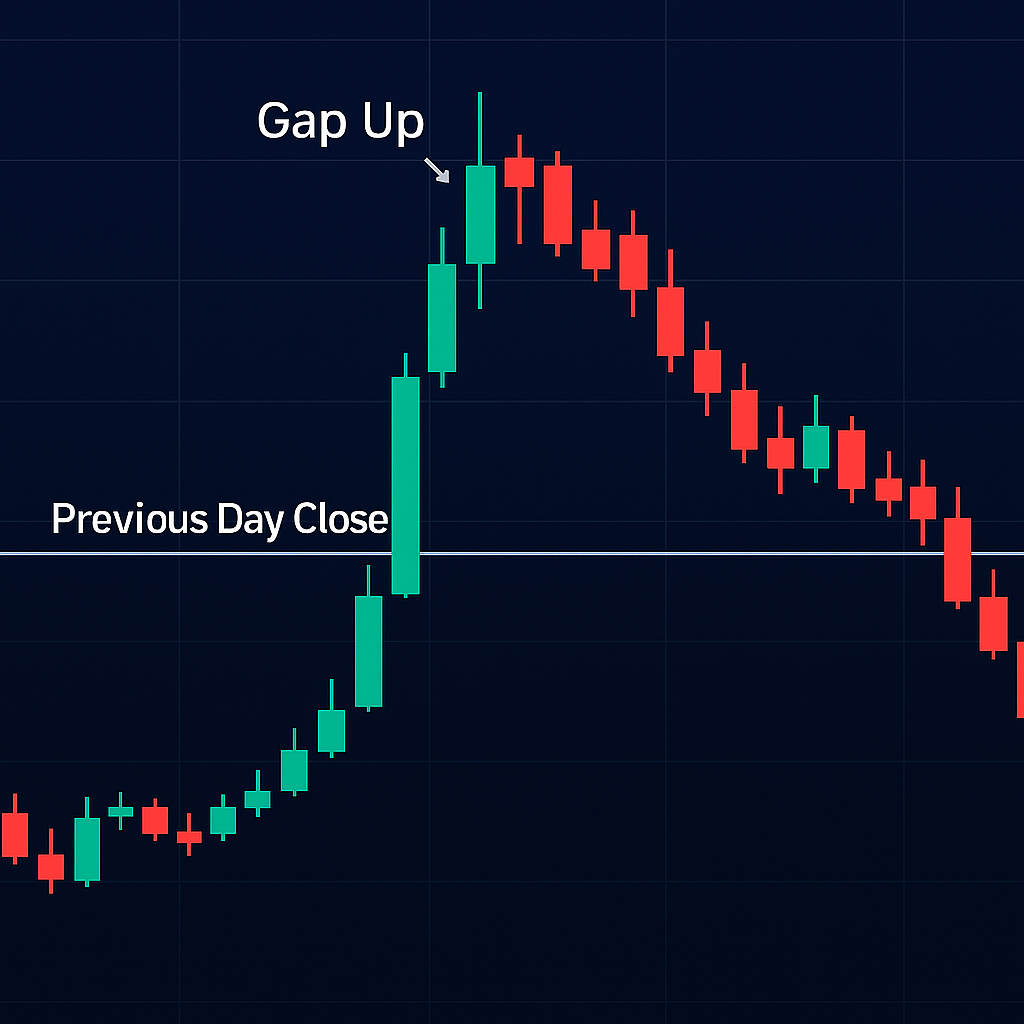

📈 Visual: What a Gap Close Looks Like

In the chart above, the stock opens higher than the previous day’s close (green gap) and later retraces down to fill that gap.

🧠 Why Do Gaps Close?

Market Psychology: Traders take profits or fade the news.

Liquidity: Institutions may re-balance positions.

Overreaction Correction: Price returns to the mean after emotional spikes.

📊 A Basic Gap Close Strategy

Entry Rules:

Identify a gap up or gap down of >1% at market open.

Wait for a confirmation candle moving toward the previous day’s close.

Enter when price breaks below (for gap up) or above (for gap down) the opening range.

Exit Rules:

Target: Previous day’s close (gap fill).

Stop Loss: Above or below the opening high/low.

Risk Management:

Use a 2:1 reward-to-risk ratio.

Avoid trading low-volume stocks.

🛠️ Tools and Indicators

VWAP (Volume Weighted Average Price): For intraday confirmation.

Pre-market High/Low levels: Determine support/resistance zones.

Volume: Spike on entry signals conviction.

🧪 Example: SPY Gap Fill

SPY gapped down 1.2%

First candle reversed upward with strong volume

Price filled the gap within 90 minutes

📌 Final Tips

Avoid earnings day gaps—they are less likely to fill quickly

Watch market sentiment and news catalysts

Practice in a simulator before using real capital

📚 Want More?

Stay tuned for our upcoming article